Compliance/Financial Considerations

If you intend to do any of the following in Canada, please contact Risk Services at risk@berkeley.edu or 642-5141:

- Hire a local to work for you as an employee

- Purchase or lease office or research space

- Purchase or lease an automobile

- Establish a long-term (over 90 days) or ongoing project

- Conduct a clinical trial

U.S. GOVERNMENT COMPLIANCE CONSIDERATIONS

Foreign activities may trigger many U.S. laws, including:

- Import Controls

- Export Controls

- Tax Reporting

- Foreign Bank Account Reporting

- Country Embargoes and Targeted Sanctions

- Foreign Corrupt Practices Act

- Anti-Boycott Laws

Import Controls. UC employees must adhere to U.S. import requirements, and may need to enlist the services of a customs broker, especially for shipments arriving by sea and subject to the Importer Security Filing 71730, also known as ISF 10+2.

Export Controls. Export controls may apply to advanced software and technology, research data, and other sensitive assets. UC’s Export Compliance FAQ contains useful information and can be found here. Go here for the University of California plan for compliance with federal export controls. If you plan on taking or sending potentially export-controlled materials to Canada, consult the campus Research Administration Compliance Office at 642-0120.

Tax Reporting. The University and its employees may be taxed in foreign countries. The tax implications for operating in Canada may be found at the Internal Revenue Service’s United States-Canada Income Tax Convention. For further clarification, contact the Controller’s Office at:

- gao@berkeley.edu or 642-0031 for tax advising and unrelated business income tax coordination, or

- payhelp@berkeley.edu or 642-1336 for foreign tax form processing

Foreign Bank Account Reporting. The U.S. Treasury Department requires U.S. citizens with a financial interest in or signatory authority over a financial account in a foreign country, where accounts exceed $10,000 at any point during a calendar year, to report such accounts on a Report of Foreign Bank and Financial Accounts (FinCen Report 114). Those needing to complete the form should contact the Controller’s Office at cashiers@berkeley.edu or 643-9803 for assistance. An IRS 1040 Schedule B form (Part III–Foreign Accounts and Trusts) must be filed by the signatory for any foreign bank account, regardless of the account balance.

Country Embargoes and Targeted Sanctions. In general, collaborations between University personnel and scholars at foreign institutions or organizations do not require export licenses unless they involve export-controlled or -restricted research or involve scholars in sanctioned countries. Before engaging in an international collaboration, the University needs to determine whether export licenses are required and to verify that the foreign collaborator is not blocked or sanctioned. The Office of Foreign Assets Control (OFAC) is responsible for enforcing all U.S. embargoes and sanctions. Depending on each country’s embargo or sanction program, activities may be prohibited without specific authorization or license. UC’s International Collaborations webpage contains additional information on this topic.

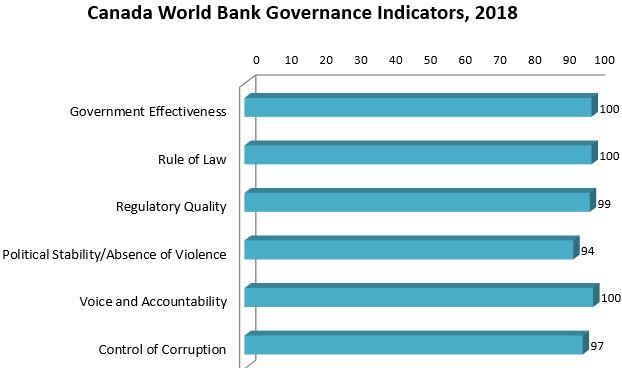

The Foreign Corrupt Practices Act (FCPA) is intended to stop bribery. It prohibits offering to pay, paying, promising to pay, or authorizing the payment of money or anything of value to a foreign official. The term “foreign official” generally includes any employee or contractor of a foreign government, and may include individuals employed by foreign universities. It is also unlawful to make a payment to a third party knowing that all or part of the payment will go to a foreign official. For more information, review the federal government’s Resource Guide to the U.S. Foreign Corrupt Practices Act. If you need further clarification, contact the UC Berkeley Office of Legal Affairs at 642-7122. Transparency International’s 2018 survey of perceived public sector corruption rated Canada at 81 out of 100 (9th out of 180 countries reviewed, i.e. clean).

Anti-Boycott Laws. The U.S. Department of Commerce is responsible for oversight of laws prohibiting individuals and entities from participating in boycotts not approved or sanctioned by the U.S. government. The Export Administration Act requires that requests to participate in such boycotts or to conduct activities in any of the boycotting countries be formally reported to the Department of Commerce and/or IRS.

For other compliance-related issues, refer to UC’s International Compliance webpage.

ADDITIONAL CONSIDERATIONS FOR DOING BUSINESS INTERNATIONALLY

Foreign Bank Accounts. Employees wishing to open a foreign bank account should contact the Controller’s Office at cashiers@berkeley.edu or 643-9803. Requests to open accounts must be made through the Office of the President’s Banking and Treasury Services Group by the Chancellor or the Chancellor’s designee.

Real Estate Agreements. Only employees with delegated authority to sign contracts on behalf of The Regents may enter into agreements, leases, or other contracts. Foreign affiliates or operations must submit to the Real Estate Services Office property management agreements, personal property leases, or contracts with a term longer than one year or in an amount greater than $25,000 per year. The campus then seeks approval from the University president or designee. For more information, consult the Guidelines for the Establishment and Operation of Foreign Affiliate Organizations and Foreign Operations

Articles

The US State Department's page on CANADA may be found HERE.

Personal Safety

CANADIAN AND US AUTHORITIES HAVE AGREED TO EXTEND A BAND ON NONESSENTIAL GROUND TRAVEL ACROSS THE TWO NATIONS' SHARED BORDER THROUGH AT LEAST NOVEMBER 21 DUE TO AN INCREASE IN CORONAVIRUS DISEASE (COVID-19) ACTIVITY. THE MEASURE, WHICH HAS BEEN IN PLACE SINCE MARCH 21, DOES NOT AFFECT TRADE OR ESSENTIAL BUSINESS TRAVEL. CANADIAN AUTHORITIES ALSO MAINTAIN A BAN ON ENTRY FOR MOST NONRESIDENT FOREIGN NATIONALS UNTIL AT LEAST OCTOBER 31. NONRESIDENT FOREIGN NATIONALS ALLOWED TO ENTER MUST BE TRAVELING FOR ESSENTIAL REASONS, AND MUST TRAVEL EITHER FROM THE US OR BE EXEMPT FROM THE RESTRICTIONS BY VIRTUE OF BEING TEMPORARY WORKERS, INTERNATIONAL STUDENTS, DIPLOMATS, AIRCREW MEMBERS OR FRENCH CITIZENS WHO LIVE IN SAINT-PIERRE AND MIQUELON.

If you are traveling to Canada on University-related business, please sign up for the University’s travel insurance program by going here. For more information on the travel insurance program, please go here.

Because everyone’s health is unique, we suggest seeking the advice of a medical professional before traveling internationally. Members of the campus community interested in protecting their health while abroad may schedule an appointment with the University Health Services International Travel Clinic

The health risks of travel to Canada are minimal. Medical care is excellent in populated areas. Ambulance service is reliable and can be reached by calling 911 from a land line. If you dial 911 from a cell phone, you will get the local sheriff’s office and response will be delayed. Disabled travelers may find helpful information here.

Air pollution can be a problem in Hinton, Sarnia, Montreal, Calgary, and Windsor. If you have a chronic respiratory condition such as asthma, please consult a medical professional prior to your trip and carry appropriate medications.

The risk of violent crime is low. Petty theft and robbery occur at tourist destinations and in low-income neighborhoods. The police are well-trained and responsive.

Legal/Political

Criminal Penalties: You are subject to local laws. If you violate local laws, even unknowingly, you may be expelled, arrested, or imprisoned. Furthermore, you may be prosecuted in the United States for some offenses even if your actions are not illegal under local law.

Arrest Notification: If you are arrested or detained, ask police or prison officials to notify the U.S. embassy or consulate immediately.

Controlled Substances: Canadian law prohibits possession and trafficking of controlled substances and narcotics, including some substances that may be legal to possess under the law of certain U.S. states. On October 17, 2018, Canada legalized the personal consumption of recreational cannabis, but Canadian law prohibits taking cannabis across Canada’s national borders, whether you are entering or leaving Canada. Drug smugglers risk substantial fines, a permanent bar from Canada, and imprisonment.

LGBTI Travelers: There are no legal restrictions on same-sex sexual relations or the organization of LGBTI events in Canada.